What is a Diecast Car HS Code?

An HS Code, which stands for Harmonized System Code, is a standardized numerical method of classifying traded products. This system is used globally by customs authorities to identify and categorize goods for taxation, tariffs, and statistical purposes. For diecast car enthusiasts and businesses alike, understanding the HS code applicable to these miniature vehicles is essential. The HS code for diecast cars helps determine import duties, taxes, and any trade restrictions that might apply. Whether you’re a collector importing a rare model or a retailer bringing in a large shipment, knowing the correct HS code is the first step towards a smooth and compliant transaction. This ensures that you accurately declare your products to customs, avoiding potential penalties and delays.

The Importance of HS Codes for Diecast Cars

HS Codes are the backbone of international trade, and they play a critical role in the import and export of diecast cars. They’re not just bureaucratic numbers; they significantly affect how your products are treated by customs. From determining the applicable tariffs and taxes to ensuring compliance with trade regulations, the HS code is paramount. Misclassifying your diecast cars can lead to significant financial consequences, including penalties, seizure of goods, and legal issues. It’s crucial to correctly identify your product to avoid these pitfalls and ensure a seamless trade experience. Furthermore, accurate classification facilitates efficient customs clearance, allowing your goods to reach their destination without unnecessary delays. In the competitive world of diecast car trading, understanding and correctly applying the relevant HS codes is a must.

Why HS Codes Matter for International Trade

HS codes standardize the classification of goods across borders, simplifying trade procedures and facilitating international commerce. They help customs officials assess duties, taxes, and apply trade policies uniformly. Proper use of HS codes reduces the risk of disputes and misunderstandings between traders and customs authorities. Without a standardized system, international trade would be far more complex, leading to delays, increased costs, and potential legal issues. The consistency offered by HS codes is essential for the smooth flow of goods across borders, supporting global economic activity. For businesses dealing in diecast cars, understanding the role of HS codes is a vital aspect of their operational strategy.

How HS Codes Affect Customs Duties and Taxes

The HS code assigned to your diecast cars directly impacts the amount of duties and taxes you will need to pay when importing or exporting them. Customs authorities use the HS code to determine the applicable tariff rates, which can vary significantly depending on the product’s classification. Incorrectly classifying a diecast car could result in paying the wrong amount of duties, which can have financial implications for your business. Properly identifying the HS code helps ensure that you comply with all financial obligations and avoid penalties. Accurate HS code application is, therefore, a crucial part of financial planning and risk management in the diecast car trade.

Top 5 Things About Diecast Car HS Codes

- HS codes are essential for classifying diecast cars for international trade.

- The correct HS code determines the applicable duties and taxes.

- Incorrect classification can lead to financial penalties and delays.

- Chapter 95 of the HS code system specifically addresses toys, games, and sports equipment, where diecast cars are often classified.

- Understanding the nuances of HS code classification is key to successful diecast car trading.

Understanding Chapter 95 of the HS Code System

Chapter 95 of the HS code system, titled “Toys, games and sports requisites; parts and accessories thereof,” is a crucial area for diecast car classification. Within this chapter, you’ll find the specific subheadings that relate to miniature vehicles. Understanding the structure of Chapter 95 is the first step in correctly classifying your diecast cars. This chapter provides a comprehensive overview of goods considered toys and games, helping you locate the most appropriate code for your products. Familiarizing yourself with this chapter ensures that you’re looking in the correct place within the HS code system, leading to more accurate classification and fewer errors.

What Are the Key Subheadings for Diecast Cars?

Key subheadings within Chapter 95 that are often relevant to diecast cars include those that specify toy vehicles and their parts. These subheadings categorize vehicles based on their type, material, and level of detail. You’ll often find distinctions based on whether the cars are motorized or non-motorized, and on their size and scale. Some codes may also differentiate based on the materials used, such as metal or plastic. Careful attention to these subheadings is crucial, as the correct choice directly affects duty rates and compliance requirements. Knowing which subheading is the best fit for your diecast car can save you from unnecessary costs and ensure that you meet all the legal requirements for trade.

Factors that Influence Diecast Car HS Code Classification

Several factors influence how diecast cars are classified, including the materials used, the scale of the model, and the level of detail and functionality. These aspects help customs authorities determine the most appropriate HS code for your specific product. Assessing these factors thoroughly is essential to ensure accurate classification, which helps avoid potential issues with customs. These elements are often interlinked; for example, a model with high detail and functionality might be classified differently from a simpler model. Understanding how these factors intersect is vital to successfully navigate the complexities of HS codes.

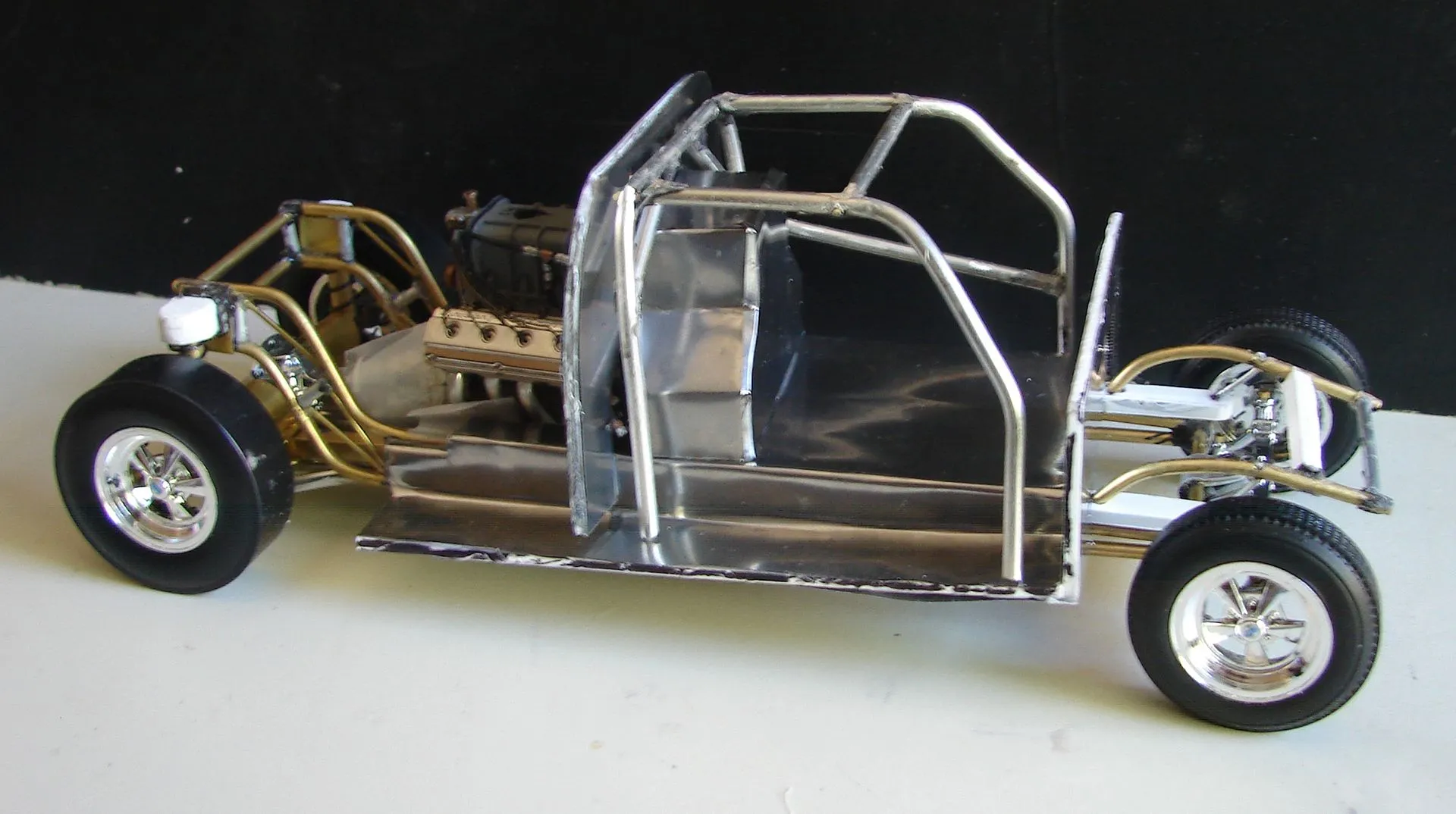

Materials Used

The materials used in manufacturing a diecast car, such as metal, plastic, or a combination, can influence its HS code. Certain codes may be designated for products made of specific materials or combinations thereof. This is because different materials may be subject to different tariffs or trade restrictions. It is essential to accurately identify the primary materials used in your diecast cars to ensure compliance. The material composition plays a significant role in determining how the product is categorized within the broader HS code system. This information is crucial for correctly completing the import or export documentation and avoiding any customs issues.

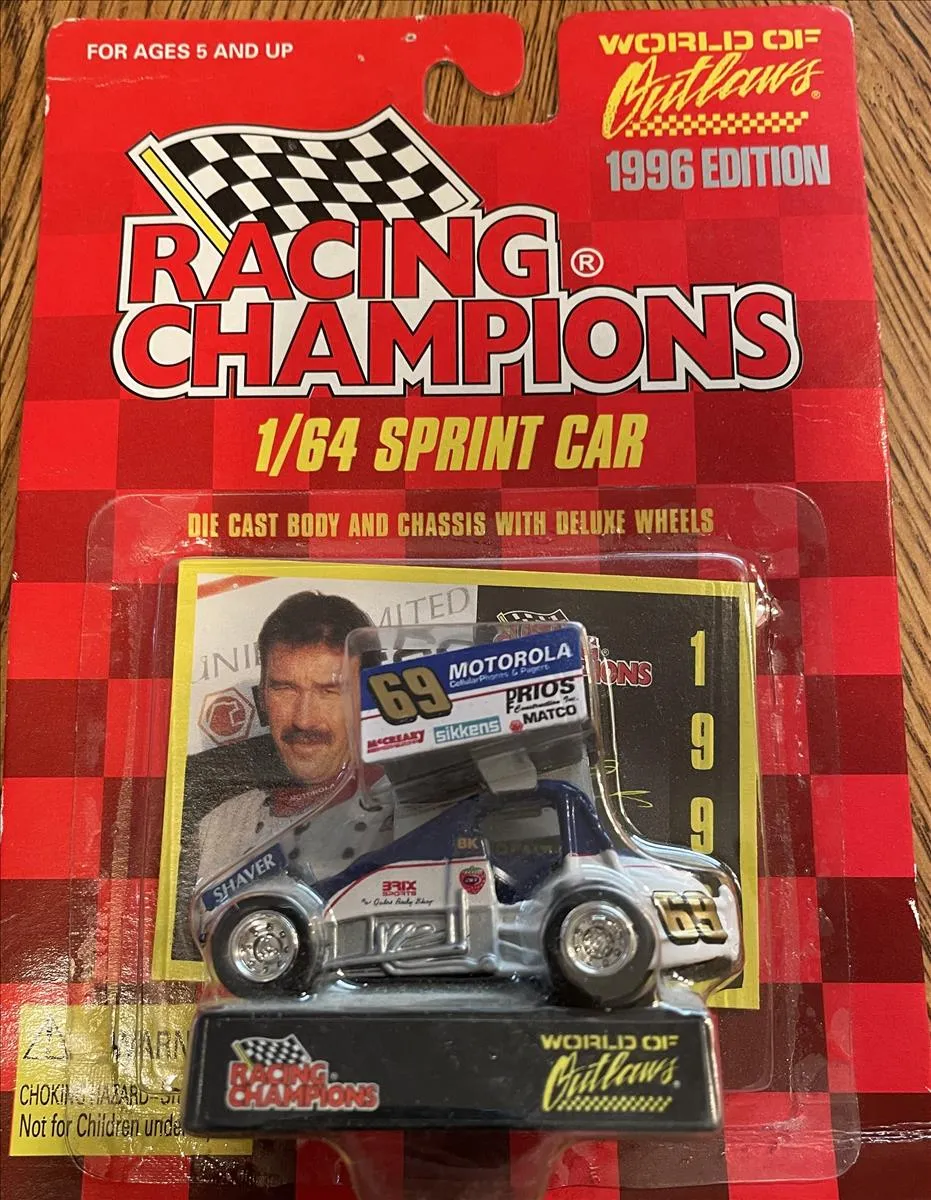

Scale of the Model

The scale of the diecast car, such as 1:18, 1:24, or 1:43, can affect its HS code classification. Size is often a key factor in differentiating between various types of miniature vehicles. Certain codes may be applicable to specific size ranges. Understanding the scale is therefore critical for accurately classifying your diecast cars. Customs authorities often use the scale of a model to categorize it, which then dictates the applicable duties and taxes. Make sure to include the scale information on your customs documents to ensure compliance. This ensures that your diecast cars are categorized correctly within the HS code framework.

Level of Detail and Functionality

The level of detail and functionality of a diecast car can influence its HS code. More complex models with greater detail and moving parts might be classified differently from simpler ones. Certain codes are designed to differentiate between toy vehicles and more sophisticated collector’s items. The level of detail often reflects the manufacturing process, and thus impacts the classification. More intricate models may be subject to different duties and taxes. Therefore, assessing the level of detail and any special functions is essential for an accurate HS code assignment.

Finding Your Diecast Car’s HS Code

Locating the correct HS code for your diecast cars can be achieved through several methods. This process usually involves researching the product’s specifications, consulting HS code databases, and, when necessary, seeking expert advice. You can start by examining the product’s characteristics, such as the materials used, scale, and level of detail. Knowing these details will help you narrow down the potential codes. When you’re unsure, using available resources and seeking professional advice will help guarantee that you assign the right HS code to your product, ensuring a smoother customs process.

Utilizing Online HS Code Search Tools

Numerous online HS code search tools are available to help you find the correct code for your diecast cars. These tools typically allow you to enter product descriptions, keywords, or even product specifications to find potential matches. They offer a convenient starting point for identifying the right HS code. Be aware, however, that these tools are not always definitive. Always verify the results with the official HS code guidelines or seek professional advice. Ensure the information is consistent with the latest HS code updates to avoid any discrepancies. When used correctly, these tools can be valuable in your initial research, streamlining the code-finding process.

Consulting with Customs Brokers or Experts

For complex or ambiguous cases, consulting with a customs broker or trade expert is highly recommended. These professionals possess in-depth knowledge of the HS code system and can provide accurate guidance tailored to your specific products. They can help you navigate the intricacies of HS code classification and ensure compliance with all relevant regulations. A customs broker or trade expert can also assist with the preparation of customs documentation. Their expertise is valuable in minimizing the risk of misclassification and ensuring that your imports or exports proceed smoothly. Investing in their services can save you time and money and, more importantly, help you avoid costly penalties.

HS Code Variations A Quick Reference Guide

HS codes are structured hierarchically, with different levels of detail indicating the product’s characteristics. The first two digits represent the chapter, the first four digits the heading, and the first six digits the subheading. Variations in these numbers can lead to significant differences in duties and taxes. The specific code assigned to a diecast car will depend on the features mentioned above. By familiarizing yourself with these codes and their meanings, you will be better equipped to handle international trade. The nuances of the HS code system emphasize the importance of accuracy and professional assistance when required. Always consult with customs brokers or trade experts if you are unsure about the code to select.

Examples of HS Codes for Diecast Cars

Here are a few example HS codes that may apply to diecast cars, but it’s essential to confirm the exact code based on the specific features of your products. Always refer to the official HS code guidelines or consult with a customs expert to determine the correct code. For instance, a specific code may be applied to vehicles made of metal, while other codes could be assigned to those made of plastic or a combination. Always consult the most recent version of the HS code to ensure accuracy, as updates can occur. The specific codes can vary based on the vehicle’s size, level of detail, and intended use. The best approach is to consult the most up-to-date resources.

Common Mistakes to Avoid

Several common mistakes can lead to HS code misclassification. One is relying on outdated information, as HS codes are updated periodically. Another mistake is failing to provide a detailed product description on customs forms. This can lead to classification errors by customs officials. It’s also important to consider all aspects of the product. Overlooking certain features might result in an incorrect HS code. Being aware of these common pitfalls can help you avoid them. Always double-check your codes and descriptions before submitting your documents to ensure accuracy. Attention to detail and diligence are essential for successful and compliant international trade.

HS Code Compliance and Benefits

Ensuring HS code compliance offers several benefits. Firstly, it helps you avoid penalties and legal issues related to customs violations. It also facilitates efficient customs clearance, reducing delays in your supply chain. Correct HS code classification improves your credibility with customs authorities. Compliance can also potentially reduce costs by ensuring that you are paying the correct amount of duties and taxes. By prioritizing compliance, you can streamline your trade processes and increase your competitiveness in the diecast car market. Prioritizing compliance means smoother transactions, reduced costs, and a more robust business.

In conclusion, understanding and correctly applying the HS code to your diecast cars is crucial for anyone involved in their import or export. It directly impacts your financial obligations, compliance with regulations, and the efficiency of your trade operations. By following the guidelines outlined in this guide and seeking expert advice when necessary, you can ensure that your diecast car business runs smoothly and compliantly. Whether you are a collector or a business owner, mastering HS codes is an investment in your success.